Small Business Confidence Plummets: Recession Looming in the US?

The recent 5-point drop in the Small Business Confidence Index has sparked concerns about a potential recession in the US, prompting economists and business owners alike to closely monitor economic indicators and prepare for possible downturn scenarios.

The **Small Business Confidence Index drops 5 points**, painting a concerning picture for the US economy. Is a recession on the horizon? Let’s delve into the factors driving this decline and what it means for small businesses.

Understanding the Small Business Confidence Index

The Small Business Confidence Index is a critical barometer of the economic health of the small business sector. It reflects the optimism or pessimism of business owners regarding future economic conditions, sales expectations, and hiring plans. A decline in this index often signals potential challenges ahead.

This index isn’t just a number; it’s a reflection of the collective sentiment of thousands of small business owners across the United States. When the index drops, it indicates that these business leaders are becoming increasingly worried about factors influencing their ability to thrive.

What Does the Index Measure?

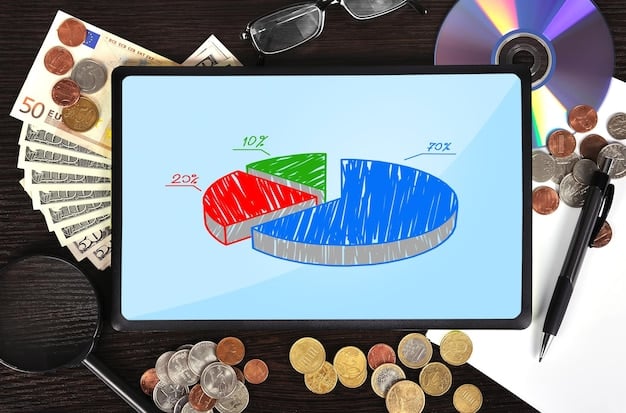

The Small Business Confidence Index typically assesses several key components that are vital to understanding the outlook of small businesses:

- Sales Expectations: Are small businesses expecting their sales to increase, decrease, or remain stable?

- Profit Trends: Are profits expected to rise or fall?

- Hiring Plans: Do businesses plan to hire new employees, reduce their workforce, or maintain current staffing levels?

- Expansion Plans: Are businesses considering expanding their operations, or are they scaling back?

A composite score derived from these factors provides an overall view of small business confidence. A higher score means greater optimism, while a lower score suggests increasing worry about economic conditions.

The Small Business Confidence Index serves as an early warning signal for potential economic downturns. Its fluctuations are closely watched by economists, investors, and policymakers.

Key Factors Contributing to the Decline

Several factors may be contributing to the recent 5-point drop in the Small Business Confidence Index. These can range from macroeconomic trends to industry-specific challenges. Identifying these factors is crucial for understanding the potential implications for the broader economy.

Small business owners don’t operate in a vacuum. External forces, such as rising interest rates, inflation, supply chain disruptions, and changing consumer behavior, significantly impact their confidence levels.

Economic Uncertainty

Heightened economic uncertainty can significantly erode small business confidence. This uncertainty can stem from various sources, including:

- Geopolitical events: International conflicts and trade tensions.

- Changes in government policies: New regulations and fiscal measures.

- Fluctuations in financial markets: Stock market volatility and interest rate hikes.

When the future becomes unpredictable, small business owners tend to become more cautious, delaying investments, reducing hiring, and minimizing risks.

Inflation and Rising Costs

Persistent inflation and the associated rise in operating costs are major concerns for small businesses. Increased costs of goods, services, and labor erode profit margins and can make it difficult for businesses to remain competitive.

Small businesses often find it challenging to pass increased costs onto consumers, particularly when consumer spending is constrained.

Inflation hurts small businesses because it reduces their purchasing power, leading to decreased sales volume and profitability. Many may resort to cost-cutting measures, impacting employee wages and benefits.

These combined factors contribute to a decline in the Small Business Confidence Index as business owners grapple with the challenges of maintaining profitability in an inflationary environment.

Historical Trends and Comparisons

Analyzing historical trends in the Small Business Confidence Index can provide valuable context to the current decline. By comparing current levels to past economic cycles, we can gain insight into whether this drop is an anomaly or a sign of a more significant downturn.

The Small Business Confidence Index has proven to be a reliable leading indicator of economic conditions. Its movements often precede broader shifts in the economy.

Past Recessions and the Index

Historically, significant declines in the Small Business Confidence Index have often preceded or coincided with economic recessions. Examples include:

- The 2008 Financial Crisis: A sharp drop in the index foreshadowed the severity of the recession.

- The Dot-Com Bubble Burst: Declining confidence reflected the emerging downturn in the technology sector.

- The COVID-19 Pandemic: The index plummeted as businesses shuttered and economic uncertainty soared.

Though the index provides an early warning, it’s important to analyze its movements in conjunction with these broader economic indicators to draw informed conclusions.

Historical comparisons provide essential context for understanding the potential trajectory of the current economic environment.

Impact on Small Businesses

A decline in the Small Business Confidence Index has far-reaching implications for small businesses. It affects their investment decisions, hiring plans, and overall growth prospects.

Small businesses are the backbone of the US economy, employing millions of people and driving innovation. Their health is directly linked to the overall economic well-being of the nation.

Reduced Investment and Hiring

When confidence declines, small businesses tend to become more risk-averse, resulting in:

Reduced investment in new equipment, technology, and marketing initiatives.

Hiring freezes or layoffs to cut costs and preserve capital.

Delayed expansion plans and decreased capital expenditures.

Such cautious behavior, while rational for individual businesses, can collectively dampen economic activity and contribute to slower growth.

A strong pullback in investment and hiring can trigger a broader economic slowdown.

Expert Opinions and Economic Forecasts

Economists and financial experts offer various perspectives on the recent drop in the Small Business Confidence Index. Their insights can provide additional context and help in assessing the likelihood of a recession.

Reading the fine print of economic indicators requires insight from those who study them closely. Experts parse every data point to contextualize trends.

Diverging Views

Some experts suggest that the decline could be a temporary correction, influenced by short-term factors like inflation and supply chain disruptions. They believe that as these pressures ease, confidence will rebound.

Other experts are more cautious, pointing to the potential for a more prolonged economic slowdown due to rising interest rates and weakening global demand.

These competing views highlight the inherent uncertainty in economic forecasting and the need for businesses to remain flexible and adaptable.

Staying informed about diverse expert opinions can help small business owners prepare for a range of possible economic scenarios.

Strategies for Small Businesses to Navigate Uncertainty

Given the current economic uncertainty, small businesses need to adopt proactive strategies to mitigate risks and protect their bottom lines. These strategies include:

Diversifying their customer base and revenue streams.

Improving cash flow management and reducing unnecessary expenses.

Investing in technology and innovation to enhance productivity and competitiveness.

Building Resilience

Here are additional actions that small businesses can consider that will help:

- Financial Prudence: Cut discretionary spending and prioritize essential investments.

- Strengthen Customer Relationships: Focus on customer retention and loyalty programs.

- Operational Efficiency: Streamline processes and look for cost-saving opportunities.

Being proactive and adaptable can significantly improve a small business’s chances of weathering economic storms.

Small businesses that focus on adaptability and resilience are better positioned to thrive in uncertain times.

| Key Point | Brief Description |

|---|---|

| 📉 Confidence Drop | Small Business Confidence Index fell by 5 points, indicating growing concerns. |

| 💰 Economic Factors | Inflation, rising costs, and economic uncertainty drive the decline. |

| 💡 Mitigation | Diversify, cut costs, innovate to navigate uncertainty. |

| 📊 Historical Context | Past drops in the index correlate with economic downturns. |

Frequently Asked Questions

▼

The Small Business Confidence Index gauges the optimism of small business owners about the economy. It is a composite of factors like sales expectations and hiring plans.

▼

The index dropped due to a mix of factors, including inflation, rising operating costs, and overall economic uncertainty. These elements have impacted business owners heavily.

▼

The drop may lead to reduced investment and hiring, as businesses become more cautious. Additionally, it could cause delays in expansion and capital expenditures.

▼

Small businesses can diversify revenue, improve cash flow management, and boost productivity by investing in technology. Adapting is key to enduring economic challenges.

▼

While some experts see a temporary correction, others warn that a longer slowdown is possible due to rising interest rates and decreased global demand. Views vary on this topic.

Conclusion

The 5-point drop in the Small Business Confidence Index serves as a warning sign that requires careful attention. For small business owners, proactive strategies, adaptability, and financial prudence will be essential to navigate the challenges ahead and emerge stronger on the other side.