How to Buy Cryptocurrency in the US: Beginner’s Guide

Buying cryptocurrency in the US involves selecting a suitable exchange, creating an account, funding it with USD, choosing the cryptocurrency you wish to buy, and securely storing your digital assets.

Interested in how to buy cryptocurrency in the US: A step-by-step guide for beginners? This article provides a comprehensive and easy-to-follow guide to navigating the world of digital currencies, even if you’re a complete novice.

Understanding Cryptocurrency Before You Buy

Before diving into the process of buying cryptocurrency, it’s crucial to understand what cryptocurrency is and the inherent risks involved. Cryptocurrency is a digital or virtual form of currency that uses cryptography for security, making it difficult to counterfeit.

While cryptocurrencies offer potential for high returns, they are also highly volatile and speculative investments. It’s essential to do your research and understand the technology and market dynamics before investing any money.

What is Cryptocurrency?

Cryptocurrency operates on a decentralized technology called blockchain, a distributed public ledger that records all transactions. This decentralization means no single authority controls the currency, making it censorship-resistant but also introducing complexities in regulation and security.

Risks and Rewards

The price of cryptocurrencies can fluctuate dramatically in short periods. Investing in cryptocurrency can lead to significant financial gains, but also substantial losses. It is crucial to assess your risk tolerance and only invest what you can afford to lose. Diversification is also key.

In conclusion, understanding both the fundamental principles of cryptocurrency and the risks involved is vital before making any investment decisions. Ensure you are well-informed and prepared for the potential volatility of the cryptocurrency market.

Choosing the Right Cryptocurrency Exchange

Selecting the right cryptocurrency exchange is the first step in buying digital currencies in the US. Different exchanges offer varying features, fees, security measures, and supported cryptocurrencies. It’s important to compare these factors to find the best platform for your needs.

Consider factors such as the exchange’s reputation, user interface, available payment methods, and customer service when making your decision. Some exchanges are more beginner-friendly than others, so choose one that aligns with your experience level.

Popular Exchanges in the US

- Coinbase: Known for its user-friendly interface and ease of use, Coinbase is a popular choice for beginners. It offers a wide range of cryptocurrencies and robust security features.

- Binance.US: Binance.US provides a wide selection of cryptocurrencies and lower fees compared to Coinbase. However, its interface may be slightly more complex for beginners.

- Kraken: Kraken is a well-established exchange known for its security and advanced trading features. It is suitable for both beginners and experienced traders.

Factors to Consider

When choosing an exchange, consider the following factors:

- Fees: Look at the trading fees, deposit fees, and withdrawal fees. Lower fees can significantly impact your overall profitability.

- Security: Ensure the exchange has strong security measures, such as two-factor authentication, cold storage of funds, and insurance coverage.

- Supported Cryptocurrencies: Check if the exchange supports the cryptocurrencies you are interested in buying.

- User Interface: Choose an exchange with an intuitive and easy-to-navigate user interface.

In conclusion, selecting the right cryptocurrency exchange requires careful consideration of various factors, including fees, security, supported cryptocurrencies, and user interface. Compare different exchanges and choose the one that best fits your needs and preferences.

Setting Up Your Account

Once you have chosen a cryptocurrency exchange, the next step is to create an account. This process typically involves providing personal information, verifying your identity, and setting up security measures.

Be prepared to provide accurate and up-to-date information, as exchanges are required to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. This helps prevent fraud and ensures the integrity of the platform.

Registration Process

The registration process usually involves providing your name, email address, and a secure password. You may also need to agree to the exchange’s terms of service and privacy policy.

Identity Verification

To verify your identity, you will typically need to provide a government-issued ID, such as a driver’s license or passport, and a proof of address, such as a utility bill or bank statement. The exchange may also require you to take a selfie or video for verification purposes.

In conclusion, setting up your account requires accurate information, adherence to KYC/AML regulations, and careful attention to security. Follow the exchange’s instructions carefully to ensure a smooth and secure account creation process.

Funding Your Account

After setting up your account, you need to fund it with US dollars (USD) to buy cryptocurrency. Most exchanges offer various payment methods, including bank transfers, debit cards, and credit cards. Each method has its own fees and processing times.

Bank transfers are usually the cheapest option but may take several business days to process. Debit and credit cards offer faster processing times but come with higher fees. Consider your budget and urgency when choosing a payment method.

Payment Methods

- Bank Transfers (ACH): Lower fees, but slower processing times (1-5 business days).

- Debit Cards: Faster processing times, but higher fees.

- Credit Cards: Similar to debit cards, with potentially higher fees and interest charges.

Security Considerations

When linking your bank account or card to an exchange, ensure you are using a secure connection and that the exchange has robust security measures in place. Consider using a virtual debit card or a separate bank account to minimize potential risks.

In conclusion, funding your account requires selecting a payment method that balances cost and speed, while also considering security. Take necessary precautions to protect your financial information and choose the most secure option available.

Buying Your First Cryptocurrency

With your account funded, you are now ready to buy your first cryptocurrency. The process typically involves selecting the cryptocurrency you wish to buy, entering the amount you want to purchase, and confirming the transaction.

Pay attention to the current market price and any associated fees before confirming the purchase. You can choose to place a market order, which executes the transaction at the current price, or a limit order, which allows you to set a specific price at which you want to buy.

Types of Orders

- Market Order: Executes the transaction immediately at the current market price.

- Limit Order: Allows you to set a specific price at which you want to buy or sell.

Choosing a Cryptocurrency

Before buying, research the different cryptocurrencies available on the exchange and choose one that aligns with your investment goals and risk tolerance. Consider factors such as market capitalization, trading volume, and project fundamentals.

In conclusion, buying your first cryptocurrency involves selecting a cryptocurrency, understanding order types, and confirming the transaction. Conduct thorough research and make informed decisions based on your investment goals and risk tolerance.

Securing Your Cryptocurrency

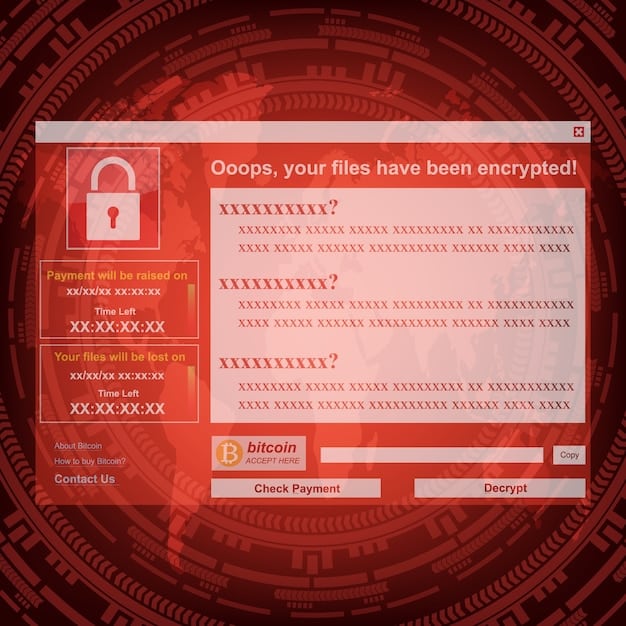

Once you have purchased cryptocurrency, it’s crucial to secure your digital assets to protect them from theft or loss. Storing your cryptocurrency on an exchange is convenient, but it also exposes you to potential risks, such as hacking or exchange failure.

Consider transferring your cryptocurrency to a private wallet, which gives you full control over your private keys. There are different types of wallets available, including hardware wallets, software wallets, and paper wallets. Each has its own advantages and disadvantages.

Types of Wallets

- Hardware Wallets: Physical devices that store your private keys offline, providing the highest level of security. Examples include Ledger and Trezor.

- Software Wallets: Applications that store your private keys on your computer or mobile device. Examples include Exodus and Electrum.

- Paper Wallets: Printed documents containing your private keys and public addresses. These are simple to create but require careful handling and storage.

Best Practices

Regardless of the type of wallet you choose, follow these best practices to secure your cryptocurrency:

- Enable two-factor authentication on your exchange account and wallet.

- Use a strong and unique password for each account.

- Keep your private keys safe and offline.

- Regularly back up your wallet.

In conclusion, securing your cryptocurrency is vital to protect your investment. Choose a suitable wallet and follow best practices to safeguard your digital assets from potential threats. Consider using a hardware wallet for long-term storage and maximum security.

| Key Point | Brief Description |

|---|---|

| 🔑 Choosing an Exchange | Select an exchange with the right fees, security, and crypto offerings. |

| 🛡️ Account Security | Always enable two-factor authentication for maximum protection. |

| 💰 Funding Methods | Consider fees and security when choosing how to fund your account. |

| 🔒 Secure Storage | Use hardware or software wallets to secure your cryptocurrency assets. |

FAQ

▼

Bitcoin (BTC) and Ethereum (ETH) are often recommended for beginners due to their established market presence and relatively lower volatility compared to smaller altcoins.

▼

Buying cryptocurrency involves risks, including market volatility and potential security breaches. Choosing reputable exchanges and securing your wallet can mitigate some of these risks.

▼

Most exchanges allow you to buy fractions of a cryptocurrency, so you can start with as little as $10 to $20. The amount you invest depends on your financial situation and risk tolerance.

▼

Fees can include trading fees, deposit fees, and withdrawal fees. These vary by exchange, so it’s essential to compare the fee structures of different platforms before making a decision.

▼

Selling cryptocurrency is similar to buying. You select the cryptocurrency you want to sell, enter the amount, and confirm the transaction. The proceeds are then credited to your exchange account.

Conclusion

Buying cryptocurrency in the US can seem daunting at first, but by following these steps, beginners can navigate the process with confidence. Remember to do your research, choose a reputable exchange, secure your assets, and only invest what you can afford to lose. Happy trading!