Diversify Your Crypto Portfolio in 2025: A US Investor’s Guide

Diversifying your cryptocurrency portfolio in 2025 is crucial for US investors to mitigate risk and capitalize on the evolving digital asset landscape, requiring a strategic approach to asset allocation and informed decision-making.

Ready to navigate the crypto world and build a resilient portfolio? How to Diversify Your Cryptocurrency Portfolio in 2025: A Guide for US Investors will help you minimize risk and maximize potential gains in the exciting world of digital assets.

Understanding the Cryptocurrency Landscape in 2025

The cryptocurrency market is constantly evolving, and 2025 promises to be another year of significant developments. Understanding the current state of the market and anticipating future trends is essential for making informed investment decisions.

This knowledge will help you build a diversified crypto portfolio. Here’s what to look for.

Market Trends to Watch

Staying ahead of the curve requires a keen eye on emerging trends. Keep tabs on regulatory changes, technological advancements, and shifts in market sentiment.

Key Technological Advancements

New technologies like Layer-2 scaling solutions, improved smart contract platforms, and advancements in decentralized finance (DeFi) are reshaping the crypto landscape.

- Layer-2 Solutions: Faster and cheaper transactions on blockchains like Ethereum.

- DeFi Innovations: New financial instruments and platforms offering unique opportunities.

- Cross-Chain Interoperability: Seamless transfer of assets and data between different blockchains.

In conclusion, understanding the ever-evolving cryptocurrency landscape is crucial for US investors to make informed decisions and optimize their portfolio diversification strategies.

Why Diversify Your Crypto Portfolio?

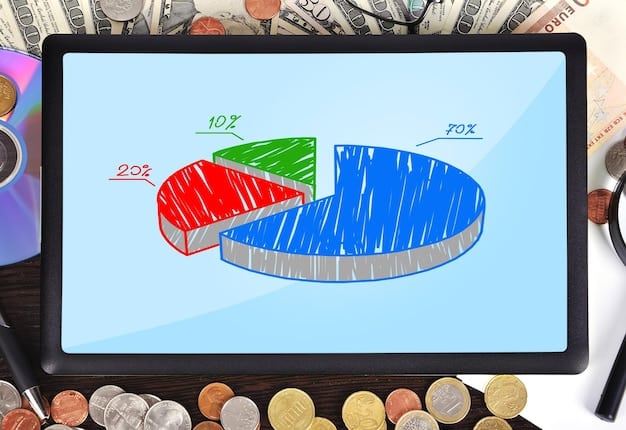

Diversification is a fundamental principle in investing, and it’s even more crucial in the volatile world of cryptocurrencies. By spreading your investments across different assets, you can significantly reduce your risk exposure.

This is how you can diversify and lower risk exposure.

Mitigating Risk

Investing solely in one or two cryptocurrencies can be highly risky. If those assets perform poorly, your entire portfolio could suffer substantial losses.

Maximizing Potential Gains

Diversifying your crypto portfolio allows you to tap into the potential of multiple assets. While some cryptocurrencies may underperform, others could experience significant growth.

- Reduced Volatility: A mix of assets can smooth out the ups and downs of the market.

- Exposure to Growth Sectors: Diversification allows you to invest in various areas like DeFi, NFTs, and Web3.

- Capitalizing on Market Cycles: Different assets perform well at different times.

In conclusion, diversification in your crypto portfolio is crucial for managing risk and maximizing the potential for gains, ensuring a more balanced and resilient investment strategy.

Asset Allocation Strategies for 2025

Effective asset allocation is the cornerstone of a well-diversified crypto portfolio. Tailoring your strategy to your risk tolerance, investment goals, and time horizon is essential for achieving optimal results.

Understanding these allocations will play a vital role.

Risk Tolerance and Investment Goals

Before allocating your assets, assess your risk tolerance. Are you comfortable with high volatility, or do you prefer a more conservative approach?

Core and Satellite Approach

This strategy involves allocating a significant portion of your portfolio to established cryptocurrencies like Bitcoin and Ethereum, which serve as the “core” of your investments.

- Core Assets: Bitcoin (BTC) and Ethereum (ETH) for stability.

- Satellite Assets: Altcoins with high growth potential.

In conclusion, strategic asset allocation, tailored to individual risk tolerance and investment goals, is vital for optimizing a cryptocurrency portfolio and ensuring long-term success.

Exploring Different Cryptocurrency Types

The cryptocurrency market offers a wide array of digital assets beyond Bitcoin. Understanding the various types of cryptocurrencies and their unique characteristics is crucial for building a well-rounded portfolio.

Here’s a deeper dive into different crypto types you can invest in.

Large-Cap Cryptocurrencies

These are the most established and well-known cryptocurrencies, such as Bitcoin and Ethereum. They generally offer more stability and liquidity compared to smaller altcoins.

Mid-Cap and Small-Cap Altcoins

Altcoins are any cryptocurrencies other than Bitcoin. Mid-cap and small-cap altcoins offer higher growth potential but also come with increased risk.

- Mid-Cap Coins: Solana (SOL), Cardano (ADA), and Polkadot (DOT) offer innovative technologies.

- Small-Cap Coins: Emerging projects with high growth potential, but higher risk.

In conclusion, diversifying across different cryptocurrency types, including large-cap, mid-cap, and small-cap altcoins, is essential for a well-rounded portfolio, balancing stability with growth potential.

Researching and Selecting Cryptocurrencies

Thorough research is essential before investing in any cryptocurrency. Understanding the technology, team, market capitalization, and potential use cases is crucial for making informed decisions.

Here are some important metrics to review before investing in new currencies.

Fundamental Analysis

This involves evaluating the underlying technology, whitepaper, team, and community support of a cryptocurrency project.

Technical Analysis

This involves analyzing price charts and trading volumes to identify patterns and predict future price movements. Technical analysis tools can help you identify potential entry and exit points.

- Price Charts: Identify trends and patterns.

- Trading Volumes: Assess market interest and liquidity.

In conclusion, thorough research, combining fundamental and technical analysis, is essential for selecting cryptocurrencies to build a well-informed and potentially profitable diversified portfolio.

Tools and Platforms for Diversification

Several platforms and tools can assist US investors in diversifying their cryptocurrency portfolios. These resources provide access to a wide range of digital assets, portfolio management features, and educational materials.

Using these tools allows for a portfolio that brings results.

Cryptocurrency Exchanges

Reputable exchanges like Coinbase, Binance US, and Kraken offer a variety of cryptocurrencies and trading tools.

Portfolio Management Tools

Tools like Blockfolio, Delta, and CoinTracker help you track your portfolio’s performance, monitor asset allocation, and manage your crypto holdings.

- Coinbase: Offers a user-friendly interface and a wide selection of cryptocurrencies.

- Binance US: Provides advanced trading features and a large number of altcoins.

- Kraken: Known for its security and professional trading tools.

In conclusion, utilizing the right tools and platforms, such as reputable cryptocurrency exchanges and portfolio management tools, is critical for US investors to effectively diversify and manage their crypto investments.

| Key Point | Brief Description |

|---|---|

| 🔑 Diversification | Reduces risk by spreading investments across various crypto assets. |

| 📈 Asset Allocation | Tailors investments to your risk tolerance and financial goals. |

| 🔬 Research | Thorough analysis of crypto projects before investing. |

| 🛡️ Risk Management | Strategies to protect your investments from market volatility. |

Frequently Asked Questions

▼

Cryptocurrency diversification involves spreading your investments across various digital assets to reduce risk. Instead of investing in just one cryptocurrency, you allocate funds to multiple coins and tokens.

▼

Diversification helps mitigate risk in the volatile cryptocurrency market. If one asset performs poorly, the impact on your overall portfolio is minimized by the positive performance of other assets.

▼

Consider including a mix of large-cap coins like Bitcoin and Ethereum, mid-cap altcoins with growth potential, DeFi tokens, and stablecoins to balance risk and potential returns in your portfolio.

▼

Rebalance your portfolio periodically, such as quarterly or annually, to maintain your desired asset allocation. This helps ensure your portfolio aligns with your risk tolerance and investment goals over time.

▼

Tools like Blockfolio, Delta, and CoinTracker can help you monitor your portfolio’s performance, track your asset allocation, and manage your crypto holdings efficiently, providing valuable insights for informed decisions.

Conclusion

Diversifying your cryptocurrency portfolio in 2025 is essential for US investors looking to navigate the evolving digital asset landscape. By understanding market trends, allocating assets wisely, and utilizing the right tools, you can build a resilient and potentially profitable crypto portfolio.