Crypto Security 2026: US Investor’s Guide to Prevent Hacks

To maximize crypto security in 2026, US investors must adopt advanced authentication, secure storage, and stay informed on evolving cyber threats, implementing robust strategies to prevent hacks and protect digital assets.

As the digital asset landscape continues its rapid evolution, ensuring the safety of your investments in 2026 is paramount. For US investors, understanding and implementing robust measures for crypto security 2026 is no longer optional but a critical necessity to prevent hacks and safeguard holdings.

Understanding the Evolving Threat Landscape in 2026

The cryptocurrency world in 2026 presents a more sophisticated threat landscape than ever before. Cybercriminals are constantly innovating, developing new methods to exploit vulnerabilities in exchanges, wallets, and even user behavior. Staying ahead requires continuous vigilance and adaptation.

Phishing attacks, though old, have become alarmingly refined, often mimicking legitimate platforms with incredible accuracy. Malware targeting crypto wallets is more insidious, capable of bypassing traditional antivirus software. Furthermore, social engineering tactics are increasingly prevalent, preying on trust and human error.

Advanced Phishing and Social Engineering Tactics

In 2026, phishing campaigns often leverage AI-generated content, making fraudulent emails and websites virtually indistinguishable from genuine ones. These attacks are highly personalized, often targeting individuals based on publicly available crypto transaction data or social media activity.

- Always verify sender identities and website URLs meticulously.

- Beware of unsolicited communications promising unrealistic returns or urgent actions.

- Use dedicated email addresses for crypto-related accounts to minimize exposure.

Sophisticated Malware and Ransomware

Malware designed to steal crypto assets has evolved to include stealthy keyloggers, clipboard hijackers, and even remote access trojans that can bypass multi-factor authentication. Ransomware attacks are also increasingly targeting individuals and smaller businesses holding significant crypto, demanding payment in digital currencies.

Conclusion: The dynamic nature of cyber threats in 2026 demands a proactive and informed approach to security. US investors must recognize that basic security practices are no longer sufficient against these advanced and evolving challenges.

Fortifying Your Digital Wallets: 2026 Best Practices

Your digital wallet is the gateway to your crypto assets, making its security the bedrock of your investment protection. In 2026, selecting the right wallet and implementing stringent security measures are crucial to prevent unauthorized access and theft.

Hardware wallets remain the gold standard for cold storage, offering robust offline protection. However, even these require careful management. Software wallets, while more convenient for active trading, demand heightened awareness of your device’s security and the applications you install.

Hardware Wallets: The Cold Storage Advantage

Leading hardware wallet manufacturers have introduced enhanced security features in 2026, including more secure element chips and advanced firmware protection against supply chain attacks. When purchasing, always buy directly from the official manufacturer to avoid tampered devices.

- Store your recovery phrase in multiple, secure, offline locations.

- Regularly update your hardware wallet firmware through official channels.

- Never expose your recovery phrase or PIN to anyone, under any circumstances.

Software and Mobile Wallets: Balancing Convenience and Security

For hot wallets, ensure you are using reputable applications with strong encryption and a proven track record. Many mobile wallets in 2026 now integrate biometric authentication and secure enclave technologies to protect private keys. Always enable all available security features.

Conclusion: By meticulously managing your digital wallets, employing a mix of cold and hot storage, and staying updated with the latest security features, US investors can significantly reduce the risk of wallet compromise in 2026.

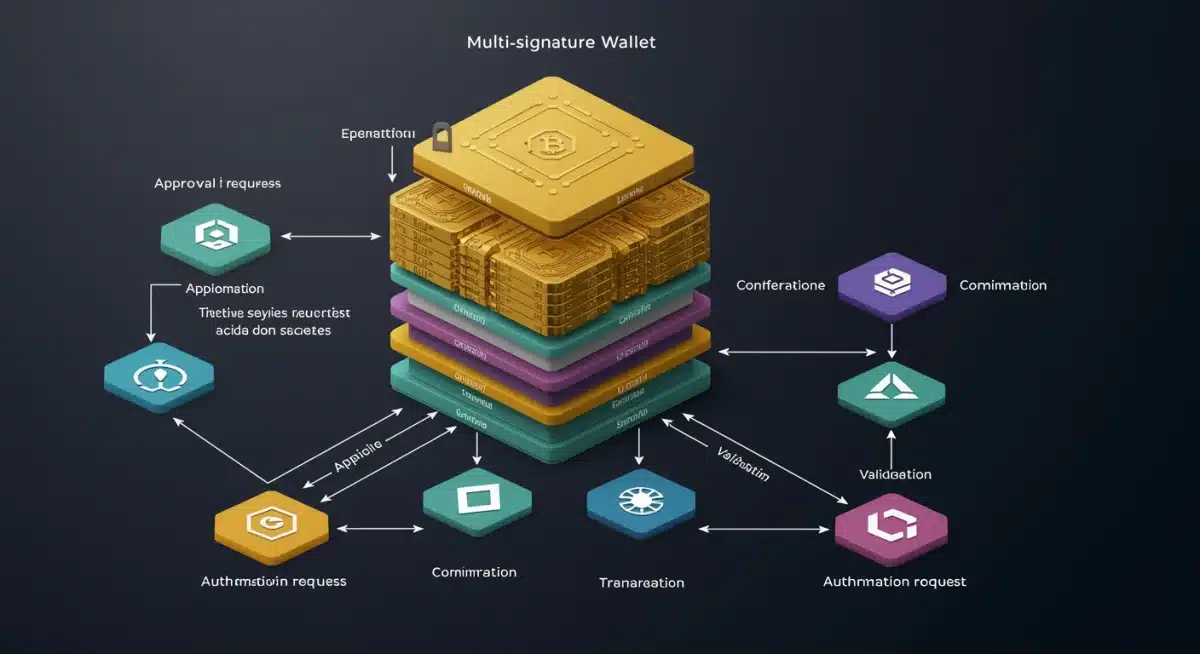

Multi-Factor Authentication (MFA): Beyond the Basics

While standard 2FA (Two-Factor Authentication) has been a staple, 2026 demands a move towards more advanced Multi-Factor Authentication (MFA) methods. SMS-based 2FA is increasingly vulnerable to SIM-swapping attacks, necessitating stronger alternatives for enhanced crypto security.

The landscape of MFA has broadened, offering more secure options that provide greater resistance against sophisticated hacking attempts. Implementing these advanced methods across all your crypto-related accounts is a non-negotiable step for any serious investor.

Hardware Security Keys (FIDO2/WebAuthn)

Hardware security keys, such as those compliant with FIDO2 or WebAuthn standards, offer the strongest form of MFA. These physical devices provide cryptographic proof of identity, making them highly resistant to phishing and man-in-the-middle attacks. They are becoming universally supported by major crypto exchanges and platforms.

Authenticator Apps and Biometric Authentication

Authenticator apps like Google Authenticator or Authy generate time-based one-time passwords (TOTP) and are significantly more secure than SMS. Many platforms also offer biometric authentication (fingerprint, facial recognition), adding another convenient yet robust layer of security, especially for mobile access.

- Enable biometric authentication wherever available for quick and secure access.

- Always back up your authenticator app keys in a secure, encrypted location.

- Avoid using the same MFA method across multiple critical accounts.

Conclusion: Upgrading your MFA strategy to include hardware keys and robust authenticator apps is a critical step in enhancing your crypto security in 2026, providing a formidable barrier against unauthorized access.

Secure Transaction Practices and On-Chain Vigilance

Executing transactions securely and monitoring on-chain activity are vital components of crypto security 2026. Mistakes during transactions can be irreversible, and understanding the flow of funds on the blockchain can alert you to potential threats or compromises.

Always double-check recipient addresses, especially when dealing with large sums. The rise of address poisoning attacks in 2026 means criminals might try to trick you into sending funds to a similar-looking address. Using services that allow for small test transactions before large transfers is a prudent practice.

Verifying Addresses and Using Whitelists

Before confirming any transaction, meticulously verify the recipient’s address character by character. Many exchanges and wallets now offer address whitelisting features, allowing you to pre-approve known addresses, which significantly reduces the risk of sending funds to an incorrect or malicious destination.

- Always use copy-paste functionality for addresses, then visually verify segments.

- Enable address whitelisting on all exchanges and wallets that support it.

- Be suspicious of any urgent requests to change withdrawal addresses.

Monitoring On-Chain Activity and Alerts

Utilize blockchain explorers to monitor your wallet addresses for any suspicious outgoing transactions. Several services in 2026 offer real-time alerts for unusual activity on your linked addresses, providing an early warning system against potential breaches. Understanding common scam patterns on the blockchain, such as unexpected token air-drops that link to phishing sites, is also crucial.

Conclusion: Diligent transaction practices and proactive on-chain monitoring are indispensable for maintaining robust crypto security in 2026, protecting your assets from costly errors and malicious activities.

Decentralized Finance (DeFi) Security: Navigating the New Frontier

DeFi continues to be a hotbed of innovation, but with great opportunity comes increased risk. In 2026, DeFi security demands a nuanced understanding of smart contract vulnerabilities, impermanent loss, and rug pulls. US investors engaging with DeFi protocols must exercise extreme caution.

Audited smart contracts are a baseline, but even these can contain undiscovered exploits. The complexity of interacting with multiple protocols and layers of liquidity pools creates a larger attack surface for sophisticated hackers. Always prioritize transparency and community reputation when choosing DeFi platforms.

Auditing Smart Contracts and Protocol Risks

Before committing funds to any DeFi protocol, thoroughly research its smart contract audits. Look for multiple, independent audits from reputable security firms. Understand the specific risks associated with each protocol, including potential for impermanent loss in liquidity pools or oracle manipulation.

- Only interact with well-established DeFi protocols with a strong security track record.

- Start with small amounts to test new protocols before committing significant capital.

- Regularly check for news and alerts regarding potential vulnerabilities in protocols you use.

Protecting Against Rug Pulls and Exit Scams

Rug pulls remain a significant threat in the DeFi space. In 2026, many projects employ subtle tactics to drain liquidity or exit with investor funds. Always investigate the team behind a project, its tokenomics, and the locking mechanisms for liquidity. Decentralized autonomous organizations (DAOs) with transparent governance models often provide better security guarantees.

Conclusion: While DeFi offers exciting investment opportunities, a deep understanding of its unique security challenges and a rigorous due diligence process are essential for US investors to protect their holdings in 2026.

Regulatory Compliance and Personal Data Protection

The regulatory landscape for cryptocurrencies in the US is continually evolving, and 2026 brings new considerations for compliance and personal data protection. Understanding these regulations is not just about avoiding legal pitfalls, but also about safeguarding your identity and financial information, which are crucial aspects of overall crypto security 2026.

New KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements are being implemented across more platforms, requiring users to share sensitive personal data. Ensuring that this data is stored and handled securely by the platforms you use is paramount.

Navigating US Crypto Regulations and Data Privacy

Stay informed about the latest regulatory updates from bodies like the SEC, FinCEN, and CFTC. Choose exchanges and service providers that are fully compliant with US law and have robust data protection policies. Understand how your personal information is collected, stored, and shared.

- Only use regulated and licensed cryptocurrency exchanges operating within the US.

- Review the privacy policies of all crypto platforms you interact with.

- Be aware of your tax obligations concerning crypto transactions, as non-compliance can lead to legal issues and data exposure.

Minimizing Digital Footprint and Online Exposure

Every piece of personal information shared online can be a potential vector for attack. Minimize your digital footprint, especially regarding your crypto holdings. Avoid publicly disclosing your portfolio size or specific assets. Use strong, unique passwords for all accounts, preferably managed by a reputable password manager.

Conclusion: Adhering to regulatory compliance and proactively protecting your personal data are foundational elements of a comprehensive crypto security strategy for US investors in 2026, mitigating both financial and identity theft risks.

| Key Security Measure | Brief Description |

|---|---|

| Advanced MFA | Utilize hardware keys and authenticator apps instead of SMS for enhanced account protection. |

| Secure Wallet Management | Prioritize hardware wallets for cold storage and employ robust software wallet practices. |

| Transaction Vigilance | Always double-check addresses and monitor on-chain activity to prevent errors and scams. |

| DeFi Due Diligence | Thoroughly research and audit DeFi protocols to mitigate smart contract and rug pull risks. |

Frequently Asked Questions About Crypto Security in 2026

The most critical step is implementing robust Multi-Factor Authentication (MFA), particularly hardware security keys. This provides the strongest defense against unauthorized access, even if your password is compromised, making it essential for protecting crypto holdings.

While no device is entirely hack-proof, hardware wallets offer the highest level of security by keeping private keys offline. Their vulnerability often lies in user error, such as compromising recovery phrases or purchasing from unofficial sources, rather than inherent device flaws.

Beyond verifying URLs, use dedicated browsers for crypto activities, enable anti-phishing codes on exchanges, and be wary of any unsolicited emails or messages. AI-generated phishing attempts are highly sophisticated, requiring constant vigilance and skepticism toward unexpected communications.

Key DeFi risks include smart contract vulnerabilities, which can lead to exploits, and rug pulls, where developers abandon projects and steal funds. Impermanent loss in liquidity pools and oracle manipulation also pose significant financial risks that investors must understand before participating.

Yes, SIM-swapping remains a significant threat, especially for accounts relying on SMS for 2FA. Cybercriminals exploit vulnerabilities in telecommunication companies to gain control of phone numbers. This underscores the importance of upgrading to hardware security keys or authenticator apps for MFA.

Conclusion

The journey to maximizing crypto security 2026 for US investors is continuous, demanding a proactive and adaptable approach. From fortifying digital wallets with advanced MFA to navigating the complexities of DeFi and adhering to evolving regulatory frameworks, each step is crucial. By integrating these practical solutions and staying informed about recent updates in the cybersecurity landscape, investors can significantly mitigate risks, prevent hacks, and confidently safeguard their valuable digital assets in a rapidly changing financial world.