Building wealth with low-risk investments: a practical guide

Building wealth with low-risk investments involves diversifying your portfolio, focusing on long-term growth, avoiding high fees, and regularly reviewing your investment strategies to enhance returns.

Building wealth with low-risk investments doesn’t have to be complicated. You might be wondering how to grow your savings without taking big risks. Let’s dive into some practical strategies that can help you achieve financial security.

Understanding low-risk investments

Understanding low-risk investments is crucial for anyone looking to secure their financial future. These options provide a way to grow your money with limited exposure to market volatility. Let’s explore the basics.

What Are Low-Risk Investments?

Low-risk investments are financial instruments that come with a lower chance of losing your principal. They have a stable return and are often favored by conservative investors.

Some popular choices include:

- Bonds – Debt securities issued by governments or companies.

- Certificates of Deposit (CDs) – Savings accounts with a fixed term and higher interest rates.

- Money Market Accounts – Savings accounts that offer higher returns than standard savings accounts.

Benefits of Low-Risk Investments

Investing in low-risk options can lead to steady growth. Unlike high-risk investments, they offer more predictable returns, making them ideal for conservative portfolios.

Investors can enjoy various advantages, including:

- Safety – Your initial investment is less likely to be lost.

- Liquidity – Many low-risk investments are easily converted back to cash.

- Income Generation – Options like bonds pay out regular interest, providing steady income.

Moreover, understanding low-risk investments can help you balance your portfolio. A mix of low and high-risk assets can reduce overall risk while allowing for growth.

In addition, many investors appreciate the peace of mind that comes with low-risk investing. Knowing your money is secure can relieve financial stress and allow for more focused long-term planning.

Top low-risk investment options

When it comes to low-risk investing, knowing the top low-risk investment options can help you make sound financial decisions. These investments allow you to grow your wealth while minimizing risks significantly.

1. Bonds

Bonds are debt securities where you lend money to governments or companies in exchange for interest. They are considered safer than stocks and can provide reliable income. Government bonds, especially those issued by stable countries, are often the safest option. On the other hand, corporate bonds may offer higher returns but come with slightly increased risk.

2. Certificates of Deposit (CDs)

CDs are time deposits offered by banks that promise a fixed return over a set period. They are insured by the FDIC up to certain limits, making them a very safe choice. You agree not to withdraw the money for a specified time, which can range from a few months to several years. The longer the term, the higher the interest rate.

3. Money Market Accounts

These accounts combine the benefits of savings and checking accounts. They typically offer higher interest rates than regular savings accounts and allow limited check-writing abilities. Money market accounts are generally safe and easily accessible, making them ideal for emergency funds.

4. Dividend-Paying Stocks

While stocks are usually considered higher risk, some established companies offer dividends that can provide regular income while maintaining lower volatility compared to growth stocks. These stocks can be a good way to achieve growth with reduced risk.

Investing in low-risk options offers peace of mind and can help you build a solid financial future without exposing yourself to unnecessary risks. As you consider your asset allocation, balancing these options in your portfolio can help maximize your returns.

How to create a balanced portfolio

Creating a balanced portfolio is essential for any investor looking to manage risk and achieve stable growth. A well-balanced portfolio includes a mix of asset types that can weather different market conditions.

Diversification

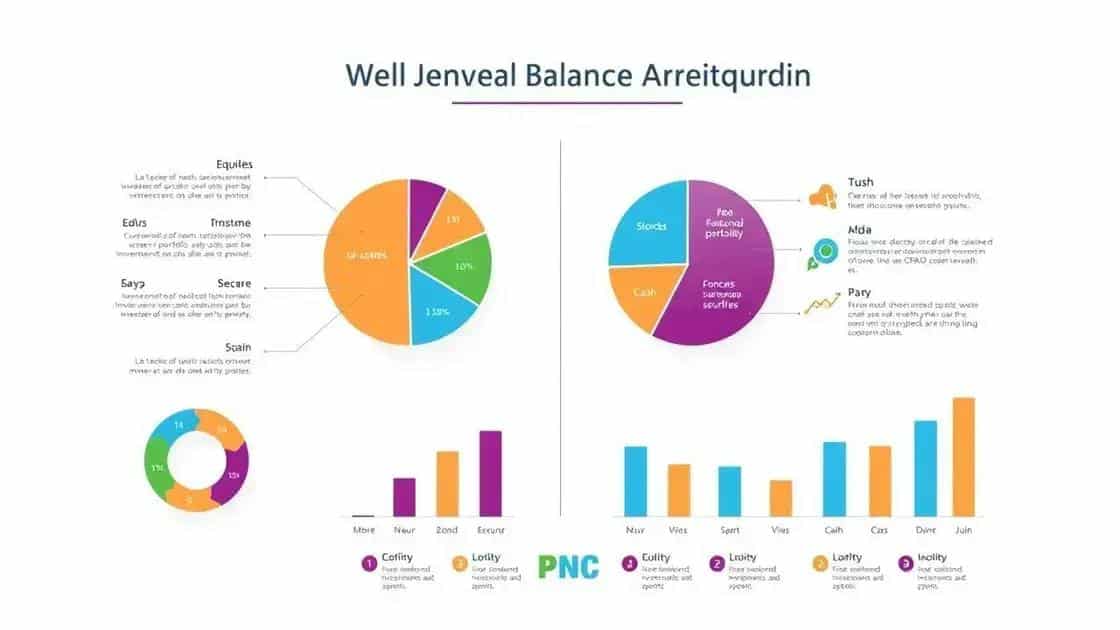

Diversification involves spreading your investments across various asset classes, such as stocks, bonds, and cash. This helps reduce risk because different assets react differently to market events. For example, when stock prices fall, bond prices might rise, balancing out potential losses.

- Stocks – Aim for a mix between growth stocks and value stocks for optimal growth.

- Bonds – Consider including both government and corporate bonds for stability.

- Cash – Keep a small percentage in cash or cash equivalents for liquidity.

Asset Allocation

Determining your asset allocation is crucial for creating a balanced portfolio. This involves deciding what percentage of your total investments will be allocated to each asset class. A common strategy is to base allocations on your risk tolerance and investment goals.

You can adjust your portfolio as you age or as your financial situation changes. Younger investors may lean more towards stocks for growth, while those nearing retirement may shift to bonds and cash for safety.

Regular Reviews

It’s important to regularly review and rebalance your portfolio. Market movements can cause your initial allocations to shift over time. By periodically reassessing your portfolio, you can ensure that it aligns with your investment strategy and risk tolerance.

Consider rebalancing at least once a year. This means selling some of your investments in categories that have grown too large and buying more in categories that have become too small.

A well-structured portfolio not only reduces risk but can also lead to better long-term returns. Keeping your investment goals in mind will guide you as you make decisions and adjustments along the way.

Strategies for maximizing returns

To achieve success in investing, it is vital to develop strategies for maximizing returns. With a thoughtful approach, you can enhance your investment income while keeping risks in check.

Diversification is Key

One of the most effective strategies is diversification. By spreading your investments across various asset classes, you can minimize risks and smooth out potential volatility. Consider a mix of stocks, bonds, and real estate. This way, if one investment performs poorly, others may perform well, providing a more stable overall return.

- Invest in different industries – This shields you from sector-specific downturns.

- Include international assets – Global investments can offer greater growth opportunities.

- Rebalance regularly – Adjust your portfolio to maintain desired asset allocations.

Invest for the Long Term

Long-term investing usually produces better returns than short-term trading. The market has ups and downs, and being patient can lead to higher returns. Compounding interest plays a significant role here. By allowing your investments to grow over time, you take advantage of compound growth.

Staying invested during market fluctuations can often yield better outcomes. The key is to remain focused on your long-term goals rather than short-term price movements.

Consider Passive Income Streams

Adding investments that generate passive income can also maximize your returns. Options include:

- Dividend-paying stocks – These provide regular income while allowing for capital appreciation.

- Real estate investments – Property ownership can yield rental income and value appreciation.

- Peer-to-peer lending – Investing in personal loans can provide interest income.

By integrating these strategies into your financial plan, you can work toward maximizing your returns while maintaining a balance between risk and reward. Regularly reviewing and adjusting your strategies can help ensure that you are on track to meet your financial goals.

Common mistakes to avoid in low-risk investing

When it comes to low-risk investing, avoiding common mistakes is just as important as choosing the right investments. Being aware of these pitfalls can help you secure steady returns while minimizing losses.

Neglecting Diversification

One mistake many investors make is putting all their money into one type of investment. Even low-risk investments need diversification. Relying solely on bonds or a single stock can expose you to unnecessary risk. Instead, spread your investments across various asset classes.

- Include both stocks and bonds – This balances growth with stability.

- Look into different sectors – Diversification protects against industry-specific downturns.

- Consider geographic diversity – Global investments can offset risks tied to local economies.

Chasing Higher Returns

Another common error is the fixation on high returns. Investors often believe that higher returns are a sign of better investments. However, chasing high yields can lead to increased risk. It’s essential to focus on the stability and security of your investments rather than merely their potential returns.

Ignoring Fees and Expenses

Many investors overlook the impact of fees on their investment returns. High management fees can eat away at your profits, especially in low-risk investments where returns tend to be modest. Always evaluate the costs associated with your investment choices.

- Choose low-fee investment options – Consider index funds or ETFs that have lower expense ratios.

- Be aware of hidden costs – Some funds have charges that aren’t immediately obvious.

Not Reviewing Your Portfolio

Failing to review your portfolio regularly can also lead to mistakes. The market can change, and your financial situation may evolve over time. It’s crucial to reassess your investments and make necessary adjustments to stay aligned with your goals.

Regularly scheduled reviews can help identify any underperforming assets and ensure a proper balance between risk and return.

In conclusion, avoiding common mistakes in low-risk investing is crucial for building wealth. By diversifying your investments, focusing on long-term gains over quick wins, paying attention to fees, and regularly reviewing your portfolio, you can enhance your financial security. Remember, a well-thought-out investment strategy can help you achieve your goals without unnecessary risks.

\n

\n

FAQ – Common Questions About Low-Risk Investing

What are the benefits of low-risk investing?

Low-risk investing provides a steady income and protects your principal while still allowing for modest growth over time.

How can I diversify my low-risk investments?

You can diversify by investing in different asset classes, such as bonds, dividend-paying stocks, and real estate.

What fees should I be aware of in low-risk investments?

Common fees include management fees, trading fees, and fund expense ratios. It’s essential to choose low-cost options whenever possible.

How often should I review my investment portfolio?

It’s recommended to review your portfolio at least once a year to ensure it aligns with your financial goals and to rebalance as needed.