Financial Planning for Millennials: Build a Solid Foundation

Financial planning for millennials is about setting financial goals, creating a budget, managing debt, investing wisely, and planning for retirement to achieve long-term financial security and success.

Financial planning for millennials is not just a trend; it’s a necessity in today’s complex financial landscape. With unique challenges like student loan debt, a competitive job market, and the ever-present pressure of lifestyle inflation, millennials need a solid financial foundation to achieve long-term success. This guide will provide you with actionable steps to take control of your finances and build a brighter future.

Understanding Your Current Financial Situation

Before diving into strategies, it’s crucial to understand where you stand. This involves assessing your income, expenses, assets, and liabilities to gain a clear picture of your financial health. Knowing your starting point allows you to set realistic goals and track your progress effectively.

Assess Your Income and Expenses

Start by tracking your monthly income, including salary, side hustle earnings, and any other sources. Then, meticulously track your expenses, categorizing them into fixed costs (rent, utilities) and variable costs (groceries, entertainment). This comparison highlights areas where you can save.

Calculate Your Net Worth

Net worth is the difference between your assets (what you own) and your liabilities (what you owe). List all your assets, such as savings, investments, and property, and subtract your liabilities, including student loans, credit card debt, and mortgages. A positive net worth indicates financial stability, while a negative one signals the need to reduce debt.

Regularly reviewing your financial situation provides insights into your spending habits and helps you stay on track toward your goals. Use budgeting tools, spreadsheets, or apps to make this process easier and more accurate. Recognizing patterns in your finances can help you adjust and optimize your financial planning.

Setting Realistic Financial Goals

Financial goals provide direction and motivation. They should be specific, measurable, achievable, relevant, and time-bound (SMART). Setting clear goals helps you prioritize your spending and saving efforts.

Identify Short-Term, Mid-Term, and Long-Term Goals

Short-term goals (1-3 years) could include paying off credit card debt or saving for a down payment on a car. Mid-term goals (3-10 years) might involve saving for a house or funding a wedding. Long-term goals (10+ years) typically focus on retirement planning and long-term investments.

Prioritize Your Goals

Not all goals are created equal. Rank your goals based on importance and urgency. For example, eliminating high-interest debt should take precedence over saving for a vacation. Prioritization ensures that you focus on the most crucial aspects of your financial life first.

- Emergency Fund: Aim to save 3-6 months’ worth of living expenses in a readily accessible account.

- Debt Management: Prioritize paying off high-interest debt like credit cards.

- Saving for Retirement: Start contributing to retirement accounts as early as possible.

- Homeownership: Plan for a down payment and associated costs.

Setting financial goals gives purpose to your financial plans. By breaking down your goals into manageable steps and tracking your progress, you’ll stay motivated and on course toward financial success. Remember that goals may evolve as your circumstances change, so revisit and adjust them as needed.

Budgeting and Expense Tracking

Effective budgeting involves creating a plan for how you’ll spend your money each month. Expense tracking helps you monitor your spending habits and identify areas where you can cut back. Together, these practices provide control over your finances.

Choose a Budgeting Method

Several budgeting methods exist, including the 50/30/20 rule (50% needs, 30% wants, 20% savings and debt repayment), zero-based budgeting (every dollar is assigned a purpose), and envelope budgeting (using cash for certain categories). Choose a method that aligns with your lifestyle and financial personality.

Track Your Expenses

Use budgeting apps, spreadsheets, or even a notebook to record your daily expenses. Categorize your spending to see where your money is going. Many apps automatically track transactions from your bank accounts and credit cards, making the process seamless.

Analyzing your spending patterns reveals areas where you can save money. Consider cutting back on discretionary spending, negotiating better deals on insurance and utilities, and exploring free or low-cost entertainment options. Small changes in your spending habits can lead to significant savings over time.

Regularly review your budget and compare your actual spending to your planned spending. Identify any discrepancies and adjust your budget accordingly. Staying flexible and adaptable is essential for maintaining a successful budget.

Managing and Eliminating Debt

Debt can be a significant obstacle to financial freedom. Developing a strategy to manage and eliminate debt is essential for millennials. This involves understanding different types of debt and prioritizing repayment efforts.

Understand the Types of Debt You Have

Common types of debt include student loans, credit card debt, auto loans, and personal loans. Each type has different interest rates and repayment terms. Prioritize paying off high-interest debt first, as it accumulates the fastest.

Debt Repayment Strategies

Consider strategies like the debt snowball method (paying off the smallest debt first for motivation) or the debt avalanche method (paying off the highest-interest debt first to save money). Another option is balance transfers to lower-interest credit cards or debt consolidation loans.

Avoiding future debt is as important as paying off existing debt. Create a budget that allows you to live within your means and avoid unnecessary borrowing. Build an emergency fund to cover unexpected expenses, reducing the likelihood of relying on credit cards. Using credit cards responsibly and paying them off in full each month can improve your credit score and prevent debt accumulation.

Managing and eliminating debt requires discipline and a strategic approach. By understanding your debt obligations, employing effective repayment strategies, and avoiding future debt, you can pave the way for a financially secure future.

Investing for the Future

Investing is crucial for building wealth and achieving long-term financial goals. Millennials have the advantage of time, allowing them to take advantage of compound interest and long-term growth potential. Understanding different investment options and risk tolerance is essential for successful investing.

Understand Investment Options

Common investment options include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate. Stocks offer higher potential returns but also come with higher risk. Bonds are generally less risky but offer lower returns. Mutual funds and ETFs provide diversification by investing in a basket of assets.

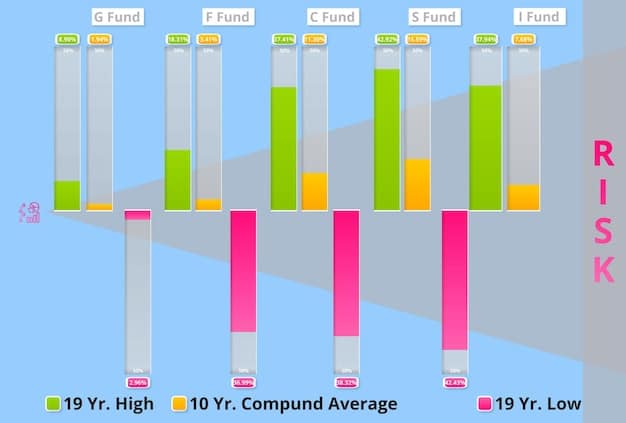

Assess Your Risk Tolerance

Consider your comfort level with risk. A conservative investor may prefer bonds and low-risk mutual funds, while an aggressive investor may be comfortable with stocks and growth-oriented investments. Your risk tolerance should align with your financial goals and time horizon.

- Start Early: The earlier you start investing, the more time your money has to grow.

- Diversify: Spread your investments across different asset classes to reduce risk.

- Stay Consistent: Regularly contribute to your investment accounts, even small amounts can add up over time.

- Rebalance: Periodically rebalance your portfolio to maintain your desired asset allocation.

Investing in your future is a powerful way to build wealth and achieve financial security. By understanding investment options, assessing your risk tolerance, and adopting sound investment practices, you can make informed decisions and work towards your long-term financial goals.

Planning for Retirement

Retirement may seem distant, but starting to plan early is crucial. Retirement planning ensures that you have enough savings to maintain your lifestyle and achieve your financial goals in your later years.

Understand Retirement Accounts

Common retirement accounts include 401(k)s, IRAs (Traditional and Roth), and Roth 401(k)s. Each account has different tax advantages and contribution limits. Take advantage of employer-sponsored 401(k) plans, especially if they offer matching contributions.

Estimate Your Retirement Needs

Calculate how much money you’ll need to cover your expenses in retirement. Consider factors like inflation, healthcare costs, and desired lifestyle. Use online retirement calculators to estimate your savings target.

Maximize your contributions to retirement accounts, especially if your employer offers matching contributions. Consider contributing to both a 401(k) and an IRA to take advantage of different tax benefits and diversify your retirement savings. Revisit and adjust your retirement plan regularly to ensure it remains aligned with your goals and circumstances.

Planning for retirement is a long-term process that requires discipline and foresight. By understanding retirement accounts, estimating your needs, and saving consistently, you can secure a comfortable and financially stable retirement.

| Key Point | Brief Description |

|---|---|

| 💰 Understand Finances | Assess income, expenses, assets, and liabilities. |

| 🎯 Set Goals | Define short-term, mid-term, and long-term SMART goals. |

| 📉 Manage Debt | Prioritize high-interest debt; consider snowball or avalanche methods. |

| 📈 Invest Wisely | Diversify investments, assess risk tolerance, start early. |

FAQ

▼

Financial planning helps millennials navigate unique challenges like student loan debt and a competitive job market, enabling them to achieve financial stability and long-term success.

▼

Choose a budgeting method that suits your lifestyle, such as the 50/30/20 rule, and track your expenses using apps or spreadsheets to identify areas where you can save.

▼

Consider the debt snowball method (smallest debt first) or the debt avalanche method (highest-interest debt first), and explore options like balance transfers or debt consolidation loans.

▼

Start early, diversify your investments across different asset classes, assess your risk tolerance, and stay consistent with your contributions to grow your wealth.

▼

Planning early ensures you have sufficient savings to maintain your lifestyle in retirement. Utilize retirement accounts and estimate your needs to secure a financially stable future.

Conclusion

Financial planning for millennials is about taking control of your financial future by understanding your current situation, setting realistic goals, managing debt, investing wisely, and planning for retirement. By implementing these strategies, you can build a solid foundation for long-term success and achieve financial security.