Altcoin Investing Risks: A US Investor’s Guide

Investing in altcoins carries significant risks for US investors, including high volatility, limited liquidity, regulatory uncertainty, and potential for fraud, requiring thorough research and risk management strategies.

Navigating the cryptocurrency market can be exciting, but it’s essential to understand what are the risks of investing in altcoins? A guide for US investors can help mitigate potential financial pitfalls.

Understanding Altcoins and Their Appeal

Altcoins, short for alternative cryptocurrencies, represent any digital currency other than Bitcoin. Their appeal lies in the potential for high returns, but this comes with increased risk.

Many US investors are drawn to altcoins hoping to find the next big thing, a cryptocurrency that will explode in value like Bitcoin did. However, it’s crucial to understand the unique characteristics of altcoins before investing.

What Makes Altcoins Different?

Altcoins often aim to improve upon Bitcoin’s technology, offering faster transaction times, enhanced privacy features, or different consensus mechanisms. This innovation can be attractive, but it also comes with uncertainty.

Some altcoins focus on specific use cases, such as decentralized finance (DeFi) or gaming. Understanding the underlying technology and purpose of an altcoin is essential for assessing its potential and risks.

- Technological Innovation: Many altcoins introduce new technologies or functionalities not found in Bitcoin.

- Specific Use Cases: Some altcoins target niche markets like DeFi or supply chain management.

- Community Support: The strength and activity of an altcoin’s community can be an indicator of its long-term viability.

Ultimately, investing in altcoins requires careful consideration of their technological advantages, intended use cases, and the strength of their community to gauge their potential success and mitigate risks.

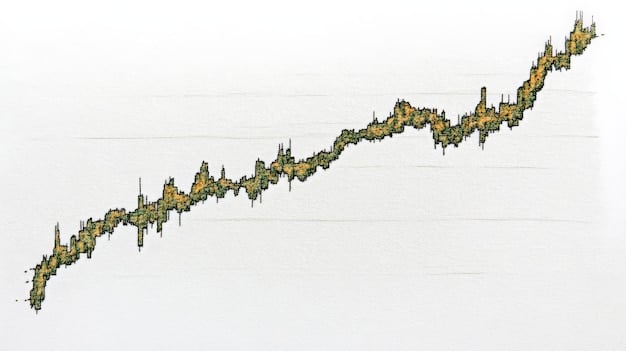

The Volatility Factor in Altcoin Investments

One of the most significant risks of investing in altcoins? A guide for US investors should emphasize the extreme volatility these digital assets exhibit. Price swings can be dramatic and rapid, leading to substantial losses.

Unlike more established assets, altcoins are subject to intense market speculation and are particularly vulnerable to sudden price corrections based on news, social media hype, or even coordinated “pump and dump” schemes.

Understanding Market Capitalization

Altcoins typically have much lower market capitalizations compared to Bitcoin, making them more susceptible to price manipulation. This lower liquidity can exacerbate volatility.

A large buy or sell order can have a disproportionate impact on an altcoin’s price, leading to significant gains or losses in a short period of time. This is a crucial factor for US investors to consider.

Impact of News and Social Media

Altcoin prices are highly sensitive to news events, regulations, and social media sentiment. A single tweet from an influential figure can send prices soaring or plummeting.

- Market Sentiment: Social media trends and news articles can heavily influence altcoin prices.

- Pump and Dump Schemes: Organized groups may artificially inflate prices before selling off their holdings.

- Regulatory Changes: Announcements related to cryptocurrency regulation can trigger significant price volatility.

Therefore, investors must be cautious and perform thorough research by consulting credible sources and checking information veracity before investing in altcoins, given how risky they are, with the likelihood of being defrauded.

Liquidity Concerns for Altcoin Investors

Liquidity refers to how easily an asset can be bought or sold without significantly affecting its price. Limited liquidity is a major risk associated with many altcoins.

Many altcoins are traded on smaller exchanges with lower trading volumes. This means it can be difficult to sell your altcoins quickly at a desired price, especially during a market downturn.

Spreads and Slippage

Low liquidity often results in wider bid-ask spreads, the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. This can eat into profits.

Slippage, the difference between the expected price of a trade and the actual price at which it is executed, is also more common with illiquid altcoins. This can lead to unexpected losses.

The bid-ask spread is the difference between the highest price that a buyer is willing to pay for an asset and the lowest price that a seller is willing to accept. For highly liquid assets, this difference is usually small.

- Trading Volume: Altcoins with low trading volumes are harder to sell quickly and efficiently.

- Bid-Ask Spreads: Wider spreads mean higher transaction costs for investors.

- Slippage: Unexpected price changes during trade execution can reduce profits.

Low liquidity is common with many altcoins, which increases the risk of incurring significant financial because of the difficulty in selling them at the desired market price, especially when you urgently need the capital.

Regulatory Uncertainty in the US

The regulatory landscape for cryptocurrencies in the United States is still evolving, adding another layer of risk to altcoin investments. The lack of clear regulations creates uncertainty and potential legal challenges.

Different government agencies, such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), have different views on how cryptocurrencies should be regulated. This ambiguity can be confusing for investors.

SEC Scrutiny

The SEC has been actively investigating and taking enforcement actions against altcoins that it deems to be securities offered without proper registration. This can lead to trading suspensions and legal battles.

If an altcoin is classified as a security, it must comply with strict regulations, including registration requirements and disclosure obligations. Failure to comply can result in significant penalties.

Potential for Future Regulations

New regulations could impact the legality, taxation, and trading of altcoins. This could lead to increased compliance costs for exchanges and investors.

Future regulations may also restrict access to certain altcoins or require stricter KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures. This can reduce liquidity and increase the cost of trading.

- SEC Enforcement: Altcoins deemed securities may face legal action and trading bans.

- Compliance Costs: New regulations can increase the operational costs for exchanges and investors.

- Tax Implications: Changes in tax laws can impact the profitability of altcoin investments.

In short, the regulatory landscape in the US is still changing, and investors must stay updated on the latest legal interpretations and legal precedents when taking investment decisions.

The Threat of Scams and Fraud

The cryptocurrency market, including altcoins, is rife with scams and fraudulent schemes. Investors need to be aware of these threats and take steps to protect themselves.

Common scams include pump-and-dump schemes, phishing attacks, and fake ICOs (Initial Coin Offerings). These schemes often target inexperienced investors with promises of quick profits.

Identifying Red Flags

Be wary of altcoins that promise guaranteed returns or have unrealistic claims. Always do your own research and verify the legitimacy of the project before investing.

Look for signs of a poorly developed website, anonymous team members, and a lack of transparency. These are often indicators of a scam.

Protecting Yourself

Use strong passwords, enable two-factor authentication, and store your altcoins in a secure wallet. Be cautious about clicking on links or downloading files from untrusted sources.

- Pump-and-Dump Schemes: Avoid investing in altcoins that are being heavily promoted with promises of guaranteed profits.

- Phishing Attacks: Be suspicious of emails or messages asking for your private keys or login credentials.

- Fake ICOs: Verify the legitimacy of ICOs before investing by checking their whitepaper and team credentials.

All in all, scams and fraud related to altcoins are quite common. Therefore investors should be alert for suspicious activities and investment calls and always remain critical.

Assessing the Technology and Whitepaper

Before investing in any altcoin, it’s essential to assess its underlying technology and carefully review its whitepaper. The whitepaper is a document that outlines the project’s goals, technology, and roadmap.

A well-written whitepaper should clearly explain the problem the altcoin is trying to solve, the proposed solution, and the technical details of the project. It should also provide information about the team, the tokenomics, and the development roadmap.

Understanding the Technology

Evaluate the altcoin’s technology and its potential advantages over existing cryptocurrencies. Is it truly innovative, or is it just a copycat project?

Look for evidence of a working product or a detailed development plan. Be wary of projects that are just ideas without any tangible progress.

Analyzing the Whitepaper

Read the whitepaper critically and look for any red flags. Is the information consistent and logical? Are the claims realistic and supported by evidence?

Pay attention to the tokenomics, the economic model of the altcoin. Is the supply limited, or is it inflationary? How are the tokens distributed? A sustainable tokenomics model is crucial for the long-term success of the project.

- Technological Innovation: Evaluate if the altcoin brings genuine technological advances or is simply a copy of other projects.

- Whitepaper Analysis: Examine the document for clarity, consistency, and the feasibility of its claims.

- Tokenomics: Understand the supply, distribution, and economic incentives of the altcoin.

In conclusion, when considering investing in altcoins, investors should critically assess the technology, to ascertain its innovative value, and the whitepaper, to confirm its legitimacy and realistic value.

Diversification and Risk Management Strategies

Given the high risks associated with altcoins, diversification and risk management are crucial for US investors. Don’t put all your eggs in one basket.

Diversification involves spreading your investments across different asset classes and altcoins. This can help reduce your overall risk and improve your chances of success.

Asset Allocation

Consider allocating only a small portion of your portfolio to altcoins, especially if you are risk-averse. Focus on more established cryptocurrencies like Bitcoin and Ethereum for the majority of your crypto holdings.

Diversify across different sectors and use cases within the altcoin market. For example, you could invest in DeFi, gaming, and privacy-focused altcoins.

Risk Management Techniques

Set stop-loss orders to limit your potential losses. A stop-loss order is an instruction to automatically sell your altcoins if the price falls below a certain level.

Rebalance your portfolio regularly to maintain your desired asset allocation. This involves selling some of your holdings and buying others to bring your portfolio back into balance.

- Asset Allocation: Allocate only a small percentage of your portfolio to high-risk altcoins.

- Stop-Loss Orders: Use these orders to automatically sell altcoins if the price drops to a certain level.

- Portfolio Rebalancing: Regularly adjust your holdings to maintain your desired asset allocation.

The smart and safest strategy for US investors is to minimize any risks to financial capital during an economic crisis by diversifying and utilizing risk management techniques when investing in altcoins.

| Key Point | Brief Description |

|---|---|

| ⚠️ Volatility | Altcoins are highly volatile; prices can change rapidly. |

| 📉 Liquidity | Low liquidity can make it difficult to sell altcoins quickly. |

| ⚖️ Regulations | Unclear regulations create uncertainty for US investors. |

| 🚨 Scams | Altcoin markets are prone to scams and fraudulent schemes. |

FAQ

▼

Altcoins are cryptocurrencies other than Bitcoin. They often aim to improve on Bitcoin’s design or offer new features and functionalities to cater to different needs.

▼

Altcoins are more volatile due to lower market capitalization, making their prices susceptible to market sentiment and news spikes. They are also prone to manipulation and speculation.

▼

Look for red flags such as guaranteed returns, anonymous team members, and poorly developed documentation. Always research and verify the legitimacy of the project before investing.

▼

The regulatory landscape for altcoins in the US is still developing. Agencies like the SEC and CFTC have different views, leading to uncertainty. Investors should stay informed with the latest developments.

▼

Diversification, setting stop-loss orders, and regularly rebalancing your portfolio can all minimize overall risk. Allocating only a small portion of your portfolio is also strategic.

Conclusion

Investing in altcoins offers the potential for high rewards but also carries substantial risks for US investors. By understanding these risks and implementing sound risk management strategies, investors can make more informed decisions and protect their capital.