Global economic forecast: what to expect in the coming years

Strategies for individuals during economic changes include reviewing personal finances, diversifying income sources, building an emergency fund, and networking to enhance job opportunities.

The economic global economic forecast presents intriguing possibilities for what lies ahead. With so many factors at play, exploring these insights can help us prepare for the changing landscape of business and finance.

Understanding the global economic forecast

Understanding the global economic forecast is essential to making informed decisions in today’s fast-paced world. The forecast helps individuals and businesses navigate uncertainties and seize opportunities as they arise.

What is the global economic forecast?

The global economic forecast examines various indicators and trends that influence economies around the world. These indicators include GDP growth, unemployment rates, and inflation. By analyzing these factors, economists can project future economic conditions.

Key Indicators to Watch

- Gross Domestic Product (GDP): This measures the overall economic output of a country.

- Unemployment Rates: High unemployment can indicate economic trouble, whereas low rates suggest growth.

- Inflation: Monitoring inflation helps predict purchasing power and cost of living changes.

Furthermore, the global economic forecast also considers external factors, such as political stability and global trade agreements. Changes in technology and consumer behavior can significantly impact future projections. For instance, the rise of e-commerce has transformed retail sectors, prompting businesses to adapt quickly.

It’s important to note that forecasts are not set in stone. They are based on current data, and as those change, so do predictions. Therefore, staying informed and adapting to new information is vital for success in any economic climate.

In conclusion, grasping the elements of the global economic forecast provides a foundation to make strategic decisions. By staying aware of these indicators and trends, individuals and organizations can position themselves favorably for future developments.

Key factors impacting the economy in 2024

Several key factors will significantly impact the economy in 2024, shaping how markets operate and how individuals make decisions. Understanding these factors will help you navigate the complexities of the global economy.

Technological Advancements

Technology continues to evolve rapidly, affecting nearly every sector. Automation and artificial intelligence are leading to increased efficiencies. Companies adopting advanced technologies often gain a competitive edge, while those lagging may struggle.

Global Trade Dynamics

The state of global trade is another critical factor in 2024. Changes in trade policies, tariffs, and international relations can significantly influence economic stability. Vibrant trade relationships foster growth, while trade tensions can lead to uncertainty and slowdowns.

- Trade Agreements: New agreements can open markets.

- Import/Export Rates: These rates affect local businesses.

- Political Stability: It impacts trade negotiations.

Furthermore, consumer confidence plays a vital role in driving economic growth. When consumers feel optimistic about their financial situation, they are more likely to spend. This spending can lead to job creation and boost overall economic performance.

Another emerging factor is the focus on sustainability. As more consumers prioritize eco-friendly practices, businesses that adopt sustainable methods may find new opportunities for growth. This trend reflects a broader shift towards corporate responsibility that can influence investor decisions and consumer behavior.

As we approach 2024, keeping an eye on these factors is essential. They will shape the landscape of both global markets and local economies. Understanding how these elements interact can prepare you to make informed decisions for the future.

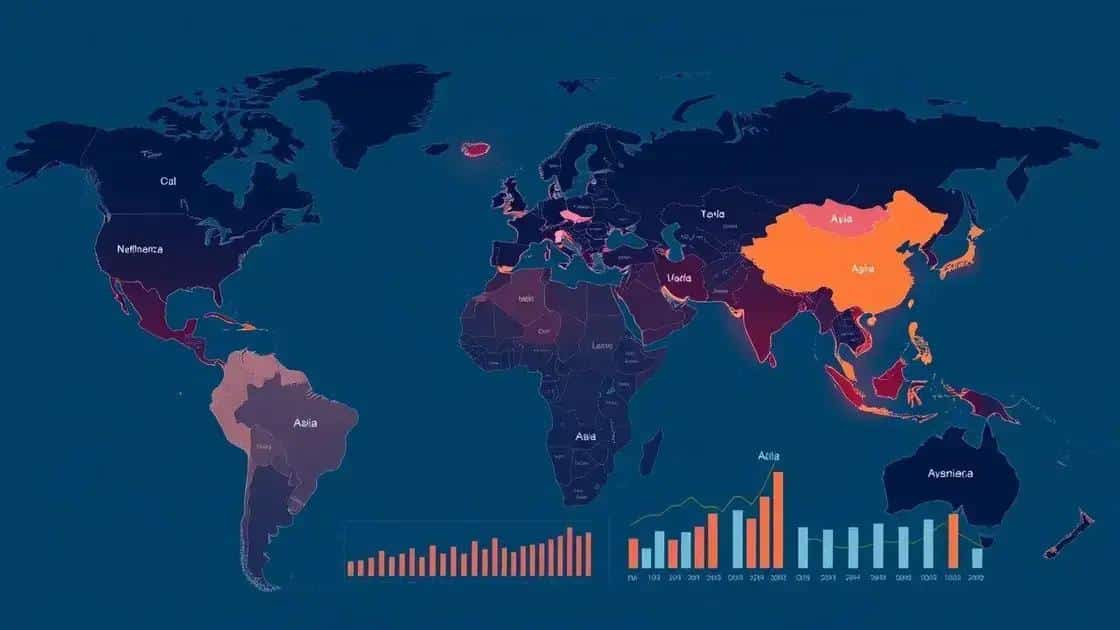

Regional economic outlooks and predictions

Regional economic outlooks and predictions play a crucial role in understanding how different areas might fare in a changing global economy. These insights allow businesses and policymakers to make informed decisions tailored to their specific regions.

North America

In 2024, North America is expected to experience moderate growth. The technology sector continues to thrive, especially in areas like artificial intelligence and software development. This growth is fueled by investment and innovation. However, challenges such as inflation and supply chain disruptions may impact overall economic stability.

Europe

Europe faces a mixed outlook. While some countries see recovery post-pandemic, others struggle with high energy costs and geopolitical issues. The European Union aims to foster sustainability, transitioning to green energy sources to boost economic resilience.

- Germany: Focused on technology and manufacturing.

- France: Investing in renewable energy.

- Italy: Tourism recovery remains key.

In Asia, strong growth is expected, especially in regions like Southeast Asia. Countries such as Vietnam and Indonesia are emerging markets poised for significant expansion. This growth is driven by a young workforce, increasing urbanization, and expanding middle classes. The demand for technology and consumer goods fuels local economies.

Latin America

Latin America is navigating economic challenges, including political instability and inflation. However, countries like Brazil and Mexico are diversifying their economies and making strides in sustainable agriculture and renewable energy. Investments in these sectors can lead to future growth.

Finally, the Middle East’s economic outlook is influenced by global oil prices. Nations like Saudi Arabia focus on diversifying their economies beyond oil, investing in tourism and technology. The region’s future hinges on balancing traditional markets with innovative sectors.

By examining these regional differences, businesses can adapt their strategies to leverage growth opportunities and mitigate risks effectively. Understanding local dynamics is crucial for making sound economic decisions.

How private sectors react to economic shifts

The reaction of the private sector to economic shifts is crucial for understanding overall market stability. Businesses often need to adapt quickly to changing conditions to remain competitive.

Adapting Business Strategies

When faced with economic changes, companies often reassess their business strategies. They may explore new markets, modify their product lines, or even change operational approaches. This flexibility allows them to respond effectively to consumer demands and economic conditions.

Investments and Innovations

Economic shifts can prompt businesses to invest in innovation. For example, during times of economic growth, companies might allocate more resources to research and development. This leads to new products and improved services, enhancing their market position.

- Technology Adoption: Companies may invest in technology to streamline operations.

- Sustainability Initiatives: Businesses often innovate to meet eco-friendly demands.

- Customer Engagement: Focusing on customer feedback can guide product adjustments.

During economic downturns, the private sector tends to tighten budgets. Companies may slow hiring, reduce expenses, and postpone large investments to weather financial storms. This cautious approach aims to preserve capital during uncertain times while assessing market conditions.

Additionally, businesses often collaborate with suppliers and partners to manage risks. Sharing resources and information can lead to better decision-making, protecting against potential losses. In sectors like retail and manufacturing, strong supplier relationships can be vital during economic transitions, ensuring stability and support.

The private sector also plays a significant role in shaping economic recovery. After economic shifts, businesses can drive growth through job creation and infrastructure development. Their engagement in community initiatives can foster resilience, benefiting both local economies and their operations.

Strategies for individuals during economic changes

Strategies for individuals during economic changes are essential for maintaining financial stability. When economic conditions shift, having a plan can help navigate these uncertainties.

Reviewing Personal Finances

First, it’s vital to assess your personal finances. Create a budget that reflects your current income and expenses. This allows you to identify areas where you can cut back if necessary. Tracking spending habits helps in making informed decisions.

Diversifying Income Sources

In uncertain times, consider diversifying your income sources. This might mean taking on a part-time job, freelancing, or investing in skills training. Developing new skills can open doors to different job opportunities, providing more security.

- Freelancing: Use your existing skills to find freelance work.

- Investing in Education: Online courses can enhance your qualifications.

- Side Hustles: Explore options like selling products or services.

Additionally, maintaining an emergency fund is crucial. Aim to save enough to cover three to six months of living expenses. This fund acts as a safety net during unexpected job losses or reduced hours. Building this fund may require discipline, but it offers peace of mind.

Networking can also be beneficial during economic shifts. Connect with others in your industry or community to share job leads or opportunities. Join professional groups or online forums to stay informed about trends and job openings. The more connections you have, the better your chances of finding new opportunities.

Finally, staying informed about economic trends and news can empower your decision-making. Understanding the market can help you predict potential changes in your job sector and adjust your strategies accordingly. Whether it’s updating your resume or seeking further education, being proactive is key.

In summary, adapting to economic changes is crucial for individuals looking to maintain stability. By reviewing personal finances, diversifying income sources, and staying informed, you can effectively navigate through uncertain times. Building an emergency fund and networking can also provide significant support. Taking proactive steps today can help secure a better tomorrow, allowing you to thrive even in shifting economic landscapes.

FAQ – Frequently Asked Questions about Economic Changes Strategies

How can I review my personal finances effectively?

Start by creating a budget that lists all your income and expenses. This helps you see where you can save money.

What are some ways to diversify my income sources?

You can take on a part-time job, freelance, or start a small business. Investing in new skills can also provide job opportunities.

Why is it important to have an emergency fund?

An emergency fund provides financial security, allowing you to cover expenses for 3-6 months during unexpected events like job loss.

How can networking help during economic shifts?

Networking connects you with industry peers, making it easier to find job leads and opportunities that may arise during economic changes.