Yield Farming Strategies for 2025: Target 12% APR Passive Income

Yield farming in 2025 presents a dynamic landscape for generating passive income in cryptocurrency, demanding strategic asset allocation and rigorous risk management to achieve a targeted 12% annual percentage rate (APR) through diversified and optimized approaches.

Are you looking to unlock substantial passive income in the rapidly evolving world of decentralized finance? As we approach 2025, Yield Farming Strategies for 2025: Maximizing Passive Income with a 12% Target APR offers a compelling avenue for investors to grow their digital assets. This guide will explore the most effective and secure methods to navigate the yield farming landscape, aiming for a significant 12% annual percentage rate while managing inherent risks.

Understanding Yield Farming Fundamentals in 2025

Yield farming, at its core, involves leveraging decentralized finance (DeFi) protocols to earn rewards on cryptocurrency holdings. Participants provide liquidity to decentralized exchanges (DEXs) or lending platforms, facilitating trades and loans. In return, they receive fees, governance tokens, or a combination of both, effectively generating passive income from their digital assets. The landscape is constantly shifting, with new protocols and opportunities emerging regularly, making continuous education crucial for success.

For 2025, the fundamentals remain, but the sophistication of strategies has evolved significantly. Investors are no longer just looking for the highest APR; they are seeking sustainable returns coupled with robust security and risk mitigation. This means a deeper understanding of underlying smart contract risks, impermanent loss, and the tokenomics of reward tokens is essential.

The Mechanics of Liquidity Provision

Liquidity provision forms the bedrock of yield farming. Users deposit pairs of tokens into a liquidity pool, which then enables others to trade between those tokens. For instance, depositing ETH and USDC into a pool allows traders to swap between ETH and USDC. The liquidity providers (LPs) earn a percentage of the trading fees generated by these swaps.

- Token Pairs: LPs typically provide two tokens in a specific ratio, often 50/50, to maintain balance within the pool.

- Liquidity Pool Tokens (LPTs): Upon depositing, LPs receive LPTs, representing their share of the pool. These LPTs can often be staked further to earn additional rewards.

- Trading Fees: A small fee is charged for every trade within the pool, distributed proportionally among LPs.

Understanding the intricacies of these mechanics is paramount, as it directly impacts potential earnings and exposure to various risks. The choice of token pairs, for example, can significantly influence impermanent loss and overall profitability.

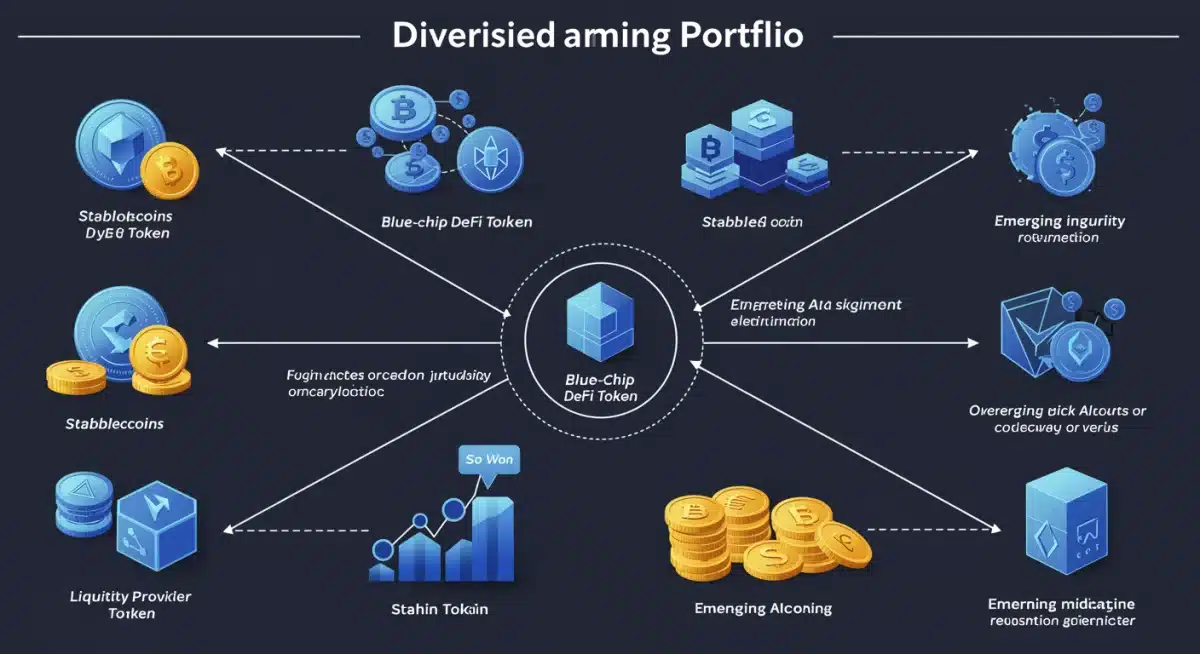

Diversified Portfolio Strategies for a 12% APR Target

Achieving a consistent 12% APR in yield farming requires a well-thought-out, diversified portfolio strategy. Relying on a single high-yield farm can be extremely risky due to volatility and potential rug pulls. Instead, spreading investments across various protocols, asset types, and risk profiles is key to sustainability and mitigating downside exposure.

In 2025, diversification extends beyond just different tokens; it encompasses different types of yield farming activities. This might include stablecoin farming, blue-chip DeFi token staking, and exploring opportunities in emerging, yet vetted, altcoin projects. The goal is to balance higher-risk, higher-reward ventures with more stable, lower-yield options to create a resilient income stream.

Balancing Risk and Reward Across Protocols

A balanced portfolio often includes a mix of established, audited protocols and carefully selected newer platforms. Established protocols like Aave, Compound, or Curve often offer lower but more stable APRs, typically ranging from 3-8%. These serve as a foundational layer for consistent returns.

- Stablecoin Farming: Providing liquidity for stablecoin pairs (e.g., USDC-USDT) generally carries lower impermanent loss risk and offers relatively stable returns.

- Blue-Chip DeFi Tokens: Staking or providing liquidity for tokens of well-established DeFi projects (e.g., UNI, AAVE, MKR) can offer higher yields but come with increased price volatility.

- Emerging Altcoins: Allocating a small portion to carefully researched new projects can yield substantial returns if successful, but these carry the highest risk.

By blending these approaches, investors can build a portfolio that aims for the 12% APR target while managing overall risk exposure. Regular rebalancing and monitoring are crucial to adapt to market changes and maintain desired risk levels.

Advanced Yield Optimization Techniques

To truly maximize passive income and reach a 12% APR, investors need to move beyond basic liquidity provision and explore advanced yield optimization techniques. These strategies often involve leveraging, compounding, and utilizing specialized platforms designed to enhance returns.

One common advanced technique is using yield aggregators. These platforms automatically move funds between different protocols to find the best available yields, handle compounding, and often reduce gas fees for users. This automation can significantly boost effective APRs by ensuring capital is always working optimally.

Leveraged Yield Farming and Its Risks

Leveraged yield farming involves borrowing additional assets to increase the amount of capital deployed into liquidity pools. While this can amplify returns, it also significantly magnifies risks, particularly liquidation risk.

- Borrowing Protocols: Platforms like Aave or Compound allow users to borrow against their existing crypto collateral.

- Increased Exposure: Borrowed funds are then used to add more liquidity, increasing both potential gains and losses.

- Liquidation Risk: If the value of the collateral drops significantly, it can be liquidated to cover the borrowed amount, leading to substantial losses.

This technique is not for the faint of heart and requires a deep understanding of market dynamics and collateral health. It is often recommended only for experienced investors with a high-risk tolerance and robust risk management strategies in place.

Another optimization technique involves understanding and actively managing impermanent loss. While it cannot be entirely avoided in volatile pairs, strategies like using stablecoin pools or actively rebalancing can help mitigate its impact. Ultimately, advanced optimization is about intelligently combining various DeFi primitives to enhance overall capital efficiency.

Identifying Secure and High-Potential Platforms for 2025

The success of any yield farming strategy hinges on selecting secure and reputable platforms. The DeFi space, while innovative, is unfortunately also a target for exploits and scams. Due diligence is not just recommended; it is absolutely mandatory, especially when aiming for a 12% APR, which often means venturing into slightly higher-risk opportunities.

For 2025, platforms with a proven track record, extensive audits, and transparent operations will be paramount. Look for protocols that have successfully navigated market downturns and have active, responsive development teams. Community engagement and governance models also play a vital role in a platform’s long-term viability and security.

Key Factors for Platform Selection

When evaluating potential yield farming platforms, several critical factors should guide your decision-making process. A thorough assessment minimizes the risk of capital loss and ensures a more sustainable passive income stream.

- Audits and Security: Prioritize platforms that have undergone multiple, reputable third-party security audits (e.g., CertiK, PeckShield).

- TVL (Total Value Locked): A high TVL often indicates trust and liquidity, though it’s not a sole indicator of safety.

- Community and Development: Active community forums, transparent communication from developers, and continuous updates are positive signs.

- Tokenomics: Understand the native token’s utility, distribution, and inflation mechanisms, as these impact long-term yield sustainability.

- Insurance Options: Some platforms offer coverage for smart contract exploits, adding an extra layer of security.

By meticulously researching these aspects, investors can significantly reduce their exposure to fraudulent projects or those with critical vulnerabilities. A selective approach to platform choice is a cornerstone of responsible yield farming.

Risk Management and Impermanent Loss Mitigation

While the allure of a 12% APR is strong, effective risk management is the bedrock of sustainable yield farming. The DeFi space is inherently volatile, and understanding and mitigating risks like impermanent loss, smart contract vulnerabilities, and market fluctuations are crucial to protecting capital and ensuring long-term profitability.

Impermanent loss is arguably the most significant risk for liquidity providers. It occurs when the price ratio of assets in a liquidity pool changes from when they were deposited. While not a “real” loss until assets are withdrawn, it means the value of your deposited assets might be less than if you had simply held them outside the pool. Strategic approaches are needed to minimize its impact.

Strategies to Counter Impermanent Loss

Mitigating impermanent loss requires a proactive and informed approach. While it can’t be entirely eliminated in volatile pairs, certain strategies can significantly reduce its effect on your overall returns.

- Stablecoin Pools: Providing liquidity for stablecoin pairs (e.g., USDC-DAI, USDT-BUSD) drastically reduces impermanent loss as their prices are pegged.

- Single-Sided Staking: Some platforms offer single-sided staking with impermanent loss protection mechanisms, though these often come with lower APRs or other trade-offs.

- High Trading Volume Pools: Pools with consistently high trading volumes generate more fees, which can offset potential impermanent loss.

- Monitoring and Rebalancing: Regularly monitoring your positions and rebalancing or exiting pools when impermanent loss becomes excessive can be effective.

Beyond impermanent loss, investors must also consider smart contract risk, which involves potential bugs or exploits in the code. Diversifying across multiple protocols and investing only in thoroughly audited projects are key defenses. Furthermore, understanding market volatility and not over-leveraging positions are fundamental to sound risk management.

Regulatory Outlook and Future Trends for Yield Farming

The regulatory landscape for cryptocurrency and DeFi is continually evolving, and 2025 is expected to bring increased clarity and, potentially, stricter oversight. Understanding these developments is crucial for any yield farmer, as regulations can impact everything from platform availability to tax obligations and the overall viability of certain strategies.

Future trends in yield farming will likely focus on enhanced security, greater capital efficiency, and more user-friendly interfaces. Layer 2 solutions will continue to play a pivotal role in reducing transaction costs and increasing speed, making yield farming more accessible and profitable for a wider audience. The integration of real-world assets (RWAs) into DeFi also presents an exciting, albeit nascent, area for future yield opportunities.

Anticipated Regulatory Changes and Their Impact

Governments worldwide are grappling with how to regulate the decentralized nature of DeFi. In the United States, discussions around stablecoin regulation, clarity on securities laws for certain tokens, and tax reporting requirements are ongoing.

- Taxation: Expect clearer guidelines on how yield farming rewards and capital gains are taxed, potentially simplifying compliance but also ensuring stricter enforcement.

- KYC/AML: Some DeFi protocols or centralized interfaces to DeFi might face increased pressure to implement Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures.

- Consumer Protection: Regulators may introduce measures aimed at protecting retail investors from high-risk DeFi products, potentially impacting access to certain high-APR farms.

Staying informed about these regulatory shifts is not merely about compliance; it’s about anticipating market reactions. A sudden regulatory crackdown could cause significant market volatility, impacting the value of farmed tokens and the overall profitability of strategies. Adaptability will be a key trait for successful yield farmers in this evolving environment.

Looking ahead, innovation in DeFi will continue at a rapid pace. Expect more sophisticated risk management tools, cross-chain yield farming opportunities, and potentially new financial primitives that redefine how passive income is generated. The journey to a 12% APR in 2025 will be dynamic, requiring both strategic insight and a keen awareness of the broader market and regulatory environment.

| Key Strategy | Brief Description |

|---|---|

| Diversified Portfolio | Spread investments across various protocols and asset types to mitigate risk and stabilize returns. |

| Advanced Optimization | Utilize yield aggregators and strategic compounding to enhance effective APRs. |

| Rigorous Platform Vetting | Prioritize secure, audited platforms with strong community support and transparent operations. |

| Risk Mitigation | Actively manage impermanent loss through stablecoin pools and monitor smart contract risks. |

Frequently Asked Questions About Yield Farming in 2025

The primary goal for yield farming in 2025 is to maximize passive income from cryptocurrency holdings, often targeting a specific annual percentage rate (APR) like 12%, through strategic liquidity provision and staking within decentralized finance (DeFi) protocols.

Achieving a 12% APR typically involves a diversified portfolio across various protocols, combining stablecoin farming with blue-chip DeFi tokens, utilizing yield aggregators, and carefully managing risks associated with higher-yield opportunities.

Key risks include impermanent loss, smart contract vulnerabilities, potential rug pulls from malicious projects, and market volatility affecting token prices. Thorough due diligence and diversification are crucial for managing these risks effectively.

Platform security is paramount. Always prioritize protocols with multiple independent security audits, a strong track record, high total value locked (TVL), and active community support to protect your invested capital from exploits.

Yes, increased regulatory clarity and potential oversight are expected to impact yield farming in 2025. This could include stricter tax reporting, KYC/AML requirements for certain interfaces, and consumer protection measures, necessitating adaptability from participants.

Conclusion

Navigating the complex yet rewarding world of yield farming in 2025 demands a strategic, informed, and cautious approach. By understanding the fundamentals, diversifying portfolios, optimizing for advanced returns, meticulously selecting secure platforms, and rigorously managing risks like impermanent loss, investors can position themselves to achieve a target 12% APR in passive income. The evolving regulatory landscape and continuous technological advancements will undoubtedly shape the future of DeFi, making ongoing education and adaptability key to sustained success in this dynamic investment frontier.